Big L Lumber Clarksville - 616-693-2227

Big L Lumber Greenville - 616-754-9339

Big L Lumber Sheridan - 989-291-3232

Big L Lumber Stanwood - 231-823-2088

Big L Lumber Clarksville - 616-693-2227

Big L Lumber Greenville - 616-754-9339

Big L Lumber Sheridan - 989-291-3232

Big L Lumber Stanwood - 231-823-2088

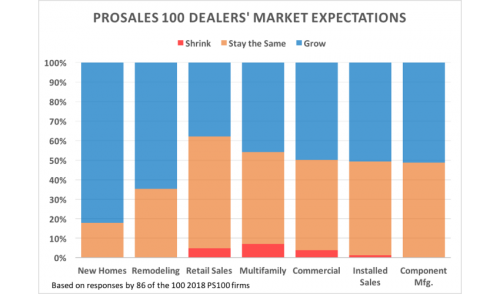

The 86 members of this year's ProSales 100 who responded to questions about prospects gave answers that align with what economists are saying. The dealers said new-home builders were most likely to bring them more revenue in 2018, with 82% of respondents expecting that customer segment to grow.

Metrostudy agrees: The data division of ProSales’ parent company predicts housing starts will rise 4.5% this year, to 1,256,000, and keep growing through 2020.

Remodelers came in second, with 65% of PS100 dealers seeing even more growth from that sector on top of what have been unprecedented boom years for repair and remodeling. REMODELING, a sister publication to ProSales, found that sales for the top 300 full-service remodelers on its Remodeling 550 list jumped 8% in 2017 from the year before and is forecast to rise another 12.2% this year. Meanwhile, the 150 biggest home improvement companies on the Remodeling 550 reported that sales rocketed 41% last year from 2016. This same group predicts a 17% jump in sales this year.

Metrostudy’s Residential Remodeling Index finds that economic conditions for remodeling today are even better than they were at the housing market’s peak in 2007—and they’ll keep improving consistently for several more years. Then there’s the Joint Center for Housing Studies of Harvard University, which predicts 2018 home improvement and repair spending will rise 6.6%, to $414 billion.

In contrast, only 38% of participant PS100 companies predicted higher sales from retail customers, and 57% expected no change. This might relate to dealers’ relative lack of interest in the segment, particularly now that pros are doing so well. Dealers were pretty evenly split on whether commercial sales would grow or remain unchanged.

Multifamily had a similar divide: 46% of the PS100 respondents predicted growth, while 47% said there’d be no change. This also was the only area with any real expectations of decline: 7% of respondents expected less business. That’s no surprise, as the multifamily segment is considered weaker these days than single-family: Metrostudy predicts virtually no growth in the segment through 2020.